Chapter 2 Overview of Different Segments of Photovoltaic Industry

On September 22, 2020, President Xi sdeclared at the 7 the 75th General Assembly of the United Nations that "China aims to hit peak emissions before 2030 and for carbon neutrality by 2060". On December 12, 2020, General Secretary Xi emphasized at the Climate Summit that "by 2030, China's CO2 emissions per unit of GDP will be lowered by more than 65% from the 2005 level. The proportion of non-fossil energy in primary energy consumption will reach about 25%, forest accumulation will increase by 6 billion cubic meters compared to 2005, and the total installed capacity of wind and solar power will reach more than 1.2 billion kWs."

In order to achieve these goals, China is vigorously developing various renewable energy sources. Solar energy to its clean, safe, inexhaustible and other significant advantages, is a significant and fastest growing renewable energy in China. Amid the Paris Agreement entering into force on November 4, 2016, the global climate anomalies occured frequently in recent years, and the fossil energy is depleting and staying in high price, the renewable energy technologies evolved rapidly, and China's PV industry are forming a strong international competitiveness, no matter in the manufacturing scale, industrialization technology level, application market expansion, or industrial system construction we are among the global forefront.

Silicon Ore

1. Overview of Photovoltaic Industry Chain

The PV industry chain involves silicon metal, polycrystalline silicon, polycrystalline silicon ingot, monocrystalline silicon rods, crystalline silicon slice manufacturing, crystalline silicon cell components, stands, inverters and PV power generation system design, installation and operation, etc.

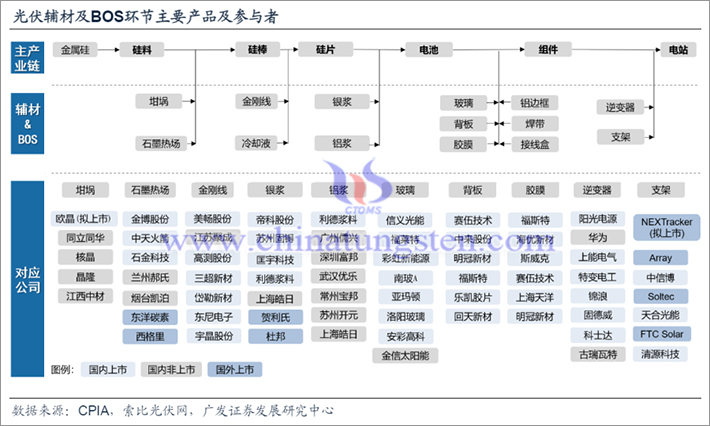

The key players in each of the major production segments of the Chinese PV industry chain at present and the overview of the chain are shown in the table below. From the table we can find that in the crystalline silicon cutting, although diamond wire is a small part of the supplementary materials of the PV industry, it accommodates at least seven listed companies. It states the high intensity of competition and the speed of technological updates in the field of diamond wire. In the future, if tungsten wire becomes the main body for diamond wire, there will be new players entering this field, in the meantime soon there would be emerging competitors in the diamond wire saw industry.

Major production segments and key players in China's PV industry chain

According to the data, the market concentration of each segment in the PV industry chain from high to low is adhesive film > glass > diamond wire saw > tracking bracket > hot field > backsheet ≈ inverter > silver paste. The CR2 in 2020 are 66% for PV adhesive film (Hangzhou First Applied Material Co., Shanghai HIUV New Materials Co), 53% for PV glass (Xinyi Solar Holdings, Flat Glass Group Co.), 53% for diamond wire saw (Yangling Metron New Material Co., Hi-Tech Co.), 46% for mounts (NEXTracker (Singapore), Array Technologies (US)), 43% for PV hot field (Jinbo Co., Zhongtian Rocket), 43% for PV backsheet (Sailwood Technology, Shaanxi Zhongtian Rocket Technology Co.), 37% for inverter (Sungrow, Huawei), and 34% for front-side silver paste (Heraeus, DK Electronic Materials)

Diamond wire is currently a very concentrated field, but as the tungsten wire welcoming a large investment in capital to start production, if the producers of tungsten wire-based diamond wire master plating technology rapidly, add with their technology accumulation advantage, financial strength and monopoly position, the tungsten diamond wire saw is likely to break the current diamond wire.

While the production process of diamond wire saw is relatively short, the current core technology of electroplated diamond wire saw includes (1) main formula of plating solution, (2) diamond micropowder pretreatment, (3) micropowder surface treatment, (4) electroplating/coating process, (5) physical and chemical analysis technology, etc. There is no critical problem in technology, as tungsten wire diamond wire is a replacement of main body of dimond wire saw.

Our examination of the production of diamond wire saw and tungsten wire in this research reveals the possibility that (1) the complexity and difficulty of tungsten wire production is higher than that of diamond wire, and it is more difficult for potential competitors to enter the field and compete with it in a short period of time. (2) The existing tungsten wire production capacity has a monopoly advantage in the short term and it better to develop downstream market, while the reverse upward development of diamond wire will face the double technical problems and market risks of tungsten wire and/or diamond powder and diamond wire. (3) Diamond wire saw involves pulling process, in the case of increasing localization rate of production equipment, the initial investment has been reduced year by year, the single line machine upgrade to multi-line machine could double the expansion of production. At present, the single GW investment amount is within 10 million yuan, so the entrance for diamond wire saw production is not high.

2. Situation of Major Materials in Photovoltaic Industry Chain

According to the information of " China PV Industry Development Roadmap (2021 Edition)" published by the China Photovoltaic Industry Association (CPIA), after more than a decade of rapid development, China's PV industry ranks among the global leaders in manufacturing scale. Industrialization technology level, application market expansion, and industrial system construction, etc., and have together formed a strong international competitiveness, and achieving.

"The PV industry aim to achieve end-to-end independent control, and is expected to take the lead in becoming a strategic emerging industry, and the industry is also an important engine for promoting domestic energy revolution." The upstream and downstream segments of the PV industry chain include six major segments: polycrystalline silicon, silicon rods/ingots/wafers, batteries, modules, inverters, systems, etc. We focus on the crystalline silicon segment related to diamond wire cutting, in order to better understand the market structure of tungsten wire as the main body of dimond wire saw.

2.1 Polycrystalline Silicon

In 2020, polycrystalline silicon reached 392,000 tons nationwide, up 14.6% year-on-year. Among them, the production of the top five enterprises accounted for 87.5% of China's total production, with four enterprises producing more than 50,000 tons. With the release of polycrystalline silicon enterprises' technical reform and capacity in 2021, the polycrystalline silicon production reached 505,000 tons, up 27.5% year-on-year. Of which, the TOP5 production accounts for 86.7% of the total domestic production, output of each company exceeds 50,000 tons. This year, with the release of polycrystalline silicon' technical reform and new production capacity, the production is expected to exceed 700,000 tons.

Monocrystalline Silicon (left) and Polycrystalline Silicon (right)

2.2 Silicon Wafers

Domestic silicon wafer production in 2020 would reach about 161.3GW, up 19.7% year-on-year. Among them, the top five companies accounted for 88.1% of China's total silicon wafer production, and their output exceeded 10GW. National silicon wafer production is expected to reach 181GW in 2021 as gaint companies accelerate their expansion. The actual national silicon wafer finished production in 2021 is 227GW, up 40.6% year-on-year. Among them, the top five companies account for 84% of the total domestic silicon wafer production, with output exceeding 10GW. With the accelerated expansion of leading companies, the national silicon wafer production is expected to exceed 293GW in 2022.

2.3 Crystalline silicon cells

In 2020, the national cell production will be about 134.8GW, up 22.2% year-on-year. Of these, the output of the top five enterprises accounts for 53.2% of the total cell production in China, with the top four manufacturers producing more than 10GW. The domestic cell production is expected to exceed 152GW in 2021, and the actual national cell production is about 198GW, up 46.9% year-on-year. Among them, the production of the top five enterprises accounted for 53.9% of the total domestic cell production, with the top six enterprises producing more than 10GW. Domestic cell production is expected to exceed 261GW in 2022.

2.4 Crystalline Silicon Components

In 2020, domestic module production reached 124.6GW, up 26.4% year-on-year, dominated by crystalline silicon components. Among them, the output of the top five companies accounted for 55.1% of the total output, with the top three companies producing more than 10GW. The capacity is expected to exceed 145GW in 2021. The actual production reached 182GW in 2021, up 46.1% year-on-year, dominated by crystalline silicon components. Among them, the production of the top five enterprises accounted for 63.4% of the total domestic module production, with the top five enterprises producing more than 10GW. Production capacity is expected to exceed 233 GW in 2022.

Various specifications of solar panels made from polycrystalline silicon and monocrystalline silicon wafers

2.5 PV Market

In 2020, our country added 48.2GW of new PV grid-connected capacity, up 60.1% year-on-year. The cumulative grid-connected PV capacity reached 253GW, ranking first in the world for both new and cumulative installed capacity. Annual PV power generation of 260.5 billion kilowatt hours, accounting for about 3.5% of the country's total annual power generation. In 2021, the new PV installation exceeds 55GW and the cumulative installation reaches about 308GW.

The actual new PV grid-connected capacity in 2021 is 54.88GW, up 13.9% year-on-year; the cumulative PV grid-connected capacity reaches 308GW, with both the new and cumulative installed capacity being the first in the world. Annual PV power generation in 2021 is 325.9 billion KW, up 25.1% year-on-year, accounting for about 4.0% of the country's total annual power generation. It is expected that the new PV installation in 2022 will exceed 75GW, and the cumulative installation is expected to reach about 383GW.

In 2021, the large-scale production of p-type monocrystalline silicon cells used PERC technology, the average conversion efficiency reached 23.1%, compared with 2020, an increase of 0.3%, conversion efficiency of the advanced enterprises reaches 23.3%. 21.0% conversion efficiency of black polycrystalline silicon cells using PERC technology, an increase of 0.2% from 2020. Conventional black polycrystalline silicon cell efficiency is not strong motivation to improve the conversion efficiency of about 19.5% in 2021, only to improve 0.1%.

2.6 Power Consumption of Rodding Process for Silicon Wafer

2.7 Single Furnace Feed of Rodding Process

2.8 Thickness of Silicon Wafer

2.9 Diameter of Base Wire of Diamond Wire Saw

2.10 Output per Unit Square Rod/ Square Ingot under Diamond Wire Saw Cutting

2.11 Market Share of Different Silicon Wafer Sizes

3. Photovoltaic Industry Trends

In the context of global energy structure transformation and the promotion of "double carbon" and efforts to stabilize growth, China's green investment performance owns a promising future represented by the explosive growth of PV industry. Combined with PV power plant projects into the "grid parity" era, the rapid release of new installed demand for global PV, the demand for crystalline silicon wafers rises sharply.

CPIA's forecast for installed capacity in 2022 gives the market an optimistic message: a conservative 180 and optimistic 225 for the global market, close to the global PV market outlook for 2022 previously published in “Global PV”. Although CPIA has lowered its expectations for installed capacity in China this year, it expects a conservative 60 and optimistic 75GW for domestic market next year.

The global PV market has huge potential, with Germany planning to reach a cumulative 215GW of PV installations by 2030. According to Bloomberg, U.S. household PV market potential could reach 454GW. Cumulative installed capacity of household PV in the United States would triple by 2030. The Netherlands is expected to have 4GW of component demand in 2022; Spain will hold about 7.0GW of module demand in 2022.

...

Read more about the report:

'Market Research of Tungsten Wire for Diamond Wire Saw in China's Photovoltaic Industry II'

'Market Research of Tungsten Wire for Diamond Wire Saw in China's Photovoltaic Industry I'

Read/download the full report, please contact China Tungsten online.